When it comes to travel health insurance and medical emergencies, I’ve found it covers a bunch of things like hospital stays, treatments, and medications—basically, lifesavers when you’re abroad! But, watch out, as some policies don’t cover pre-existing conditions. Emergency evacuation is also key; it can whisk you away to the nearest hospital if needed. And don’t forget about dental emergencies; they’ve got your back for cracked teeth! Want to know more about other benefits?

Key Takeaways

- Travel health insurance covers emergency medical expenses, including hospital stays, treatments, and medications for unexpected illnesses or injuries while traveling.

- Emergency medical evacuation provides necessary transport to medical facilities, including specialized ambulances or air ambulances if required.

- Coverage may include repatriation services to return you home if necessary, often with trained medical escorts.

- Policies typically exclude pre-existing conditions, high-risk activities, and routine medical or dental care, so verify specifics in the fine print.

- 24/7 assistance is available for emergencies, ensuring support and access to local healthcare facilities during your travels.

Coverage for Emergency Medical Expenses

When I think about traveling, I often get excited about the adventures ahead, but I can’t help but worry about the “what ifs.” You know, like what if I’m wandering through the streets of Paris, indulging in some amazing croissants, and suddenly need medical help? That’s where emergency medical expenses coverage comes into play. I’ve learned that depending on the policy, coverage amounts can range considerably—think $10,000 up to a whopping $2 million! It’s essential to do some coverage comparisons to avoid nasty surprises, especially since many policies have exclusions for pre-existing conditions or even injuries from high-risk activities. Trust me, you don’t want to be stuck paying for a million-dollar hospital bill while munching on pastries!

Emergency Medical Evacuation and Transportation

Imagine you’re trekking through the breathtaking landscapes of Patagonia, fully immersed in the moment, when suddenly you take a misstep and twist your ankle. Ouch! Now, you might think, “Uh-oh, how do I get out of here?” That’s where emergency transport kicks in. With medical evacuation coverage, you’re not just left to hobble back. Instead, you could get a specialized ambulance or even airlifted by an air ambulance, all while being monitored by a trained medical escort. They guarantee you get to the nearest adequate facility safely. Plus, if things get serious, plans often include bringing you back home. Trust me, having this coverage can make a world of difference; it’s like carrying a safety net on your adventures.

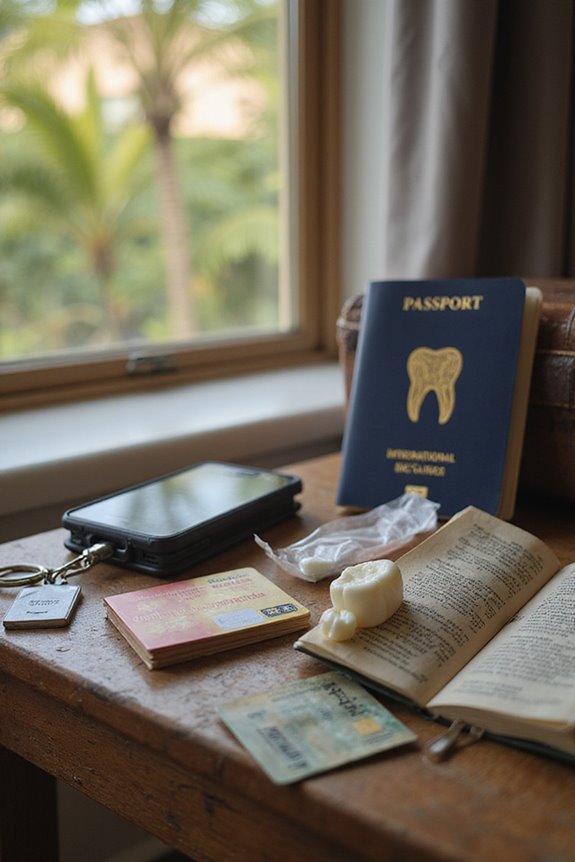

Emergency Dental Coverage

While trekking through beautiful terrains, the last thing you want is to deal with a toothache or, worse, a dental injury. Trust me, I’ve been there. Emergency dental coverage can be a lifesaver during your travels. It typically covers those unexpected dental emergencies, like cracked teeth or a sudden, agonizing toothache, requiring urgent care. However, don’t expect it to cover routine stuff like cleanings or fillings—those are out. Most plans will handle natural teeth, though, so if you chip a tooth from biting into something too hard, you’ll be thankful for the coverage. Just remember, the specifics can vary widely. So, it’s crucial to read the fine print and know what you’re getting into before you hit the road!

Additional Covered Benefits Related to Medical Emergencies

You might think travel health insurance is just about covering doctor visits, but there’s so much more to it, especially when it comes to medical emergencies. For instance, if I found myself in a sticky situation and need emergency evacuation, the coverage limits can be a lifesaver, ranging from $500,000 to, get this, unlimited! And if I’m traveling with a pre-existing condition, it’s comforting to know that repatriation services could include professionals who understand my needs. There’s also 24-hour emergency assistance to help find hospitals or arrange transportation; I’d never feel stranded. Plus, trip interruption coverage can save me from extra travel costs if my plans go sideways. Trust me—having these benefits makes travel much less stressful!

Exclusions and Limitations in Travel Medical Insurance

Even if you think you’ve got your travel health insurance squared away, there are quite a few exclusions and limitations that could catch you off guard. For instance, exclusions based on conditions like pre-existing issues, mental health setbacks, or routine check-ups can leave you in the lurch when something unexpected happens. And let’s not forget about high-risk activities like bungee jumping—if you don’t have that extra coverage, you might just end up with a hefty bill from your thrill-seeking adventure. Policy limitations explained? Sure, regular wear and tear from life—like dental check-ups or pregnancy—rarely make the cut. So, be sure to read the fine print before you jet off; it could save you from a travel headache later!

Determining Coverage Limits for Your Trip

After figuring out what exclusions and limitations might put a damper on my travel health insurance, the next step is all about finding the right coverage limits for my trip. I’ve learned that coverage recommendations vary by age. For example, if I’m over 80, aiming for $50,000 is wise, while those under 70 have a buffet of options from $50,000 to $8 million! I mean, who wouldn’t want that peace of mind? Plus, I’ve got to take into account destination healthcare costs—expensive places need higher coverage. Then there’s my health profile and planned activities—if I’m bungee jumping or hiking in a remote area, that’s a whole different ball game! Choosing the right coverage guarantees I won’t be stuck with hefty out-of-pocket expenses.

Importance of Medical Evacuation and Repatriation Benefits

When traveling to far-flung places, the importance of having solid medical evacuation and repatriation benefits can’t be overstated. Imagine hiking in the mountains, and suddenly, you twist your ankle so badly that walking becomes a challenge. Without medical evacuation, getting to a decent hospital could take hours, if not days! It’s not just about avoiding discomfort; it could save your life. Those repatriation benefits are equally essential. If things go south, returning home for proper care should be seamless. No one wants to juggle logistics while recovering from an injury abroad. Trust me, having these benefits is like having a safety net—it makes all the difference. Adventure awaits, but let’s make sure we’re covered when life throws a curveball!

Availability of 24/7 Emergency Assistance Services

Have you ever found yourself in a pinch while traveling, wondering how on earth you’d get help if something went wrong? Trust me, that’s where 24/7 emergency assistance services come to the rescue. With just a call or tap on your smartphone, you’ve got access to emergency contacts available at any hour, no matter where you are. These services offer everything from locating nearby doctors and hospitals to helping you understand medical jargon if language barriers pop up. Plus, they can coordinate transportation and even assist with replacing your prescription meds! Thanks to modern assistance technology, I’ve had peace of mind knowing expert help is just a call away, turning travel mishaps into minor bumps in the road.

Understanding Claim Procedures and Documentation

Steering through the claim procedures for travel health insurance can feel like deciphering a complex puzzle, especially when you’re already in a stressful situation. I remember fumbling with claim documentation after a sudden illness abroad, and it wasn’t pretty! You’ll need copies of all bills and itemized receipts showing what services were provided. Don’t forget your passport and completed claim forms. Familiarizing yourself with billing methods is essential—direct billing means the provider handles payments directly with the insurer, which can save you money upfront. As soon as you can, submit your claim online, attaching clear scans of everything! Trust me, staying organized and keeping copies of everything will make following up so much easier when unexpected requests come in.

Choosing the Right Travel Health Insurance Plan

Steering through the world of travel health insurance can feel downright overwhelming, especially after dealing with the chaos of filing a claim. I remember staring at a stack of plans, wondering where to even begin! When choosing the right plan, I always recommend comparing plans side by side, looking closely at coverage limits and those all-important emergency evacuation options. Evaluating needs is key—if you’re heading somewhere with pricey medical care, opt for higher coverage limits. Make sure to check for 24/7 assistance, just in case you need help finding a doctor at 2 AM. Don’t forget to read the fine print, especially regarding exclusions; no one wants surprises when it comes to medical emergencies on the road!

Frequently Asked Questions

Does Travel Health Insurance Cover Pre-Existing Medical Conditions?

When I think about travel health insurance, I know pre-existing conditions can have coverage limitations. It’s essential to read the policy closely, as some plans might not cover what you expect for those conditions.

Are High-Risk Activities Covered Under Travel Health Insurance?

I’ve learned that high-risk sports often fall outside standard travel health insurance. Many policies have coverage limitations, so I always check for specific adventure insurance to guarantee I’m protected when engaging in risky activities.

How Do I File a Claim for Medical Expenses?

Filing a claim’s like a puzzle; every piece counts! I gather required documents, complete the claim process accurately, and submit everything as specified. Keeping copies guarantees I have my bases covered throughout the journey.

What Happens if I Need Care in a Country Without Coverage?

If I need care in a country without coverage, I’ll likely face high costs. Emergency evacuation might be necessary to an international hospital, so I always guarantee my plan includes this option before traveling.

Can I Customize My Travel Health Insurance Policy?

Steering through the travel insurance jungle, I found countless customization options to shape my policy limits. Tailoring coverage not only safeguarded my adventures but also transformed worries into confidence, letting me explore the world without fear.