So, pre-existing conditions in travel insurance are basically any health issues or injuries you’ve had before your policy kicks in. Think asthma or that pesky knee injury from years back. These conditions can seriously affect your coverage—sometimes they even lead to higher premiums or outright exclusions. Imagine getting stuck with a claim denial just because you didn’t disclose your little asthma episode from last month. But don’t worry, there are ways to navigate these twists and turns successfully!

Key Takeaways

- Pre-existing conditions refer to any medical issues that existed before the travel insurance policy started, affecting coverage options.

- Common examples include chronic illnesses, such as asthma, diabetes, and heart conditions, which can influence insurance premiums and reimbursement limits.

- Coverage for pre-existing conditions varies; some plans may exclude specific conditions, while waivers can protect against exclusions if eligibility criteria are met.

- Travelers must disclose all relevant medical history to avoid claim denials, as insurers typically require details from the last 60 to 180 days.

- It’s essential to plan and research insurance options early, considering factors like health stability and possible local healthcare resources while traveling.

Definition of Pre-Existing Conditions

When I think about travel insurance, the term “pre-existing condition” always pops into my head, and for good reason. You see, a pre-existing condition is any illness or injury that I had before my travel insurance policy kicks in—it could be my asthma or that pesky knee injury from last summer. What’s fascinating is how insurance terminology defines these conditions to help insurers figure out the risk. If I’ve had treatment or symptoms within a certain lookback period, usually 60 to 180 days, they might consider it a pre-existing condition. It’s like I’m holding my past medical history in my hands when booking that dream trip. So, understanding this can save me from unexpected headaches later on!

Impact on Travel Insurance Coverage

Knowing how pre-existing conditions can affect my travel insurance coverage is super important. I’ve learned that these conditions can lead to significant coverage implications. For instance, if I have a chronic issue like asthma, the insurance might offer higher reimbursement limits if my condition was stable during the lookback period. However, that also means I’ll likely face premium adjustments, which can make my travel insurance more expensive. Plus, the plans can vary widely; some might cover acute outbreaks, while others might not cover anything related to my condition at all. It’s essential to read the fine print and honestly disclose my health history to avoid being stuck with a denied claim, and no one wants that headache on their trip!

Waivers and Qualification Criteria

While diving into the world of travel insurance can feel overwhelming, understanding waivers and qualification criteria is absolutely essential if you want to avoid nasty surprises later on. For instance, to be eligible for a waiver, you generally need to purchase your policy within a specific window—often 14 to 21 days post-trip payment. Plus, your health status matters; if you’ve been recently treated or hospitalized, you might not qualify. It’s vital to disclose all known conditions and guarantee they’ve been stable. I remember stressing about this for my last trip, anxious about meeting waiver eligibility. Trust me, a little early planning can save you a heap of trouble down the road, turning potential heartache into smooth sailing instead!

Common Examples of Pre-Existing Conditions

Maneuvering the maze of travel insurance means you’ll likely stumble upon pre-existing conditions; trust me, they can feel like a dark cloud just waiting to rain on your vacation parade. Imagine this: asthma management can be a hurdle if you’ve had recent flare-ups or treatments. Then there’s diabetes control, a classic pre-existing condition; insurers aren’t too keen if your levels have been anything but steady. But wait, there’s more! Chronic diseases like hypertension, heart issues, and arthritis often join the party. Even mental health conditions can pop up, demanding transparency. It’s like walking through a minefield—one wrong step and you’re suddenly questioning your trip! So, keeping an eye on your health stability is essential before that getaway.

Disclosure and Documentation Requirements

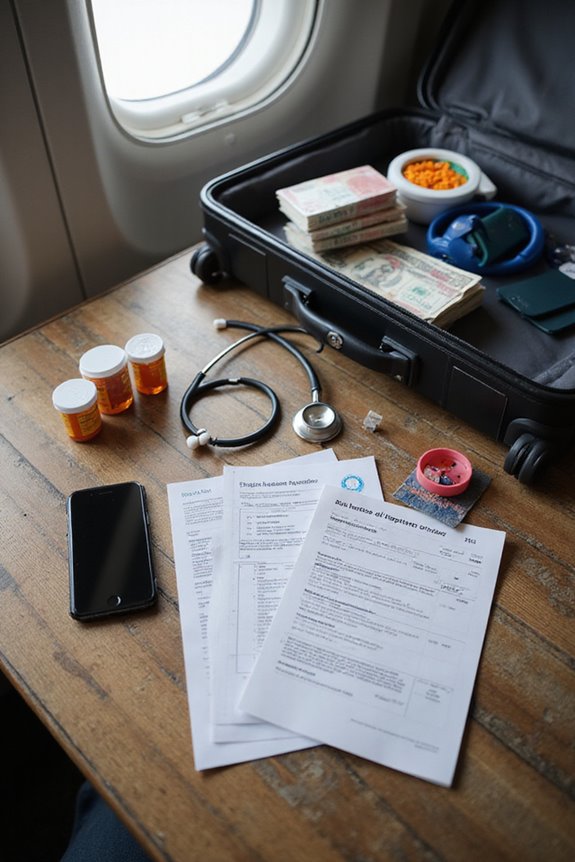

When you’re prepping for a trip, all the buzz around travel insurance and pre-existing conditions can feel a bit like a puzzle missing its final piece. Trust me, I’ve been there! To guarantee you get covered, you’ve gotta be all about disclosure accuracy. That means listing every medical condition you had before buying the policy—usually within the last 60 to 180 days. Don’t forget the paperwork! Being documentation-ready means having your medical history, treatment plans, and a doctor’s note confirming you’re fit to travel handy. If you miss a detail, your claim could be denied, and you’ll be left high and dry. So, before that suitcase hits the floor, make sure everything’s squared away!

Strategic Advice for Travelers With Pre-Existing Conditions

Traveling with pre-existing conditions can feel like walking a tightrope, but with a bit of savvy planning, you can keep your balance and enjoy the ride. First, I always schedule my trips when I’m at peak health stability; it really helps avoid flare-ups. Remember, research insurance plans like Allianz and Travel Guard—they’ve saved me during tough times with great coverage. Don’t forget to meet waiver eligibility; I make sure to pay the full trip cost before buying my insurance. Also, I never leave home without my medications and copies of prescriptions. Finally, I plan for emergencies—knowing local healthcare and carrying essential information brings peace of mind. Trust me, these travel tips can turn a potential nightmare into a fun adventure!

Frequently Asked Questions

Can I Change My Policy After Disclosing a Pre-Existing Condition?

I can’t easily make policy modifications after disclosing a pre-existing condition. Coverage limitations usually prevent changes unless specific criteria are met. It’s essential to disclose everything early to avoid complications later.

Will My Travel Companions’ Conditions Affect My Coverage?

Absolutely, my travel companions’ conditions can impact my coverage due to companion disclosure. Understanding shared risks is essential, as their medical issues might affect claims. I always check policy details to know potential exclusions.

How Does Age Affect Pre-Existing Condition Coverage?

Last year, my 75-year-old uncle faced age limitations that restricted his coverage options for a trip. As I learned, insurers often impose stricter rules on older travelers, especially regarding pre-existing conditions.

Are There Specific Insurers Known for Better Pre-Existing Condition Coverage?

I’ve found that insurer comparisons reveal some companies offer more extensive coverage for pre-existing conditions. Travel Insured International and Allianz stand out, but it’s vital to review each plan’s specifics before deciding.

What Happens if My Condition Worsens During My Trip?

If my condition worsens during the trip, it can complicate the claim process. Medical emergencies usually qualify for coverage, but it’s essential I’ve documented stability beforehand and notified the insurer promptly for support.