When I’m budgeting for a vacation, I usually set aside around $5,051, especially since that’s the projected average spent per trip in 2025. I like to break it down into categories: transportation, accommodation, food, and fun activities. Don’t forget those unexpected costs, like souvenirs or emergency fees! And honestly, it’s all easier when you plan for some wiggle room. Plus, if I strategically use travel rewards, I can save a chunk. Let’s explore how to keep your budget intact!

Key Takeaways

- Determine your average trip costs, factoring transportation, accommodation, food, and activities, which can total around $5,051 for U.S. travelers in 2025.

- Categorize your budget for clear tracking, including transportation, accommodation, dining, activities, and miscellaneous expenses, to avoid overspending.

- Utilize travel rewards programs to offset costs and maximize savings, allowing for more flexibility in your budget.

- Consider off-peak travel to secure better deals and lower costs, enhancing your overall vacation experience.

- Allocate a reserve fund for unexpected expenses, such as medical emergencies or last-minute activities, to ensure a stress-free trip.

Understanding Average Vacation Budgets for 2025

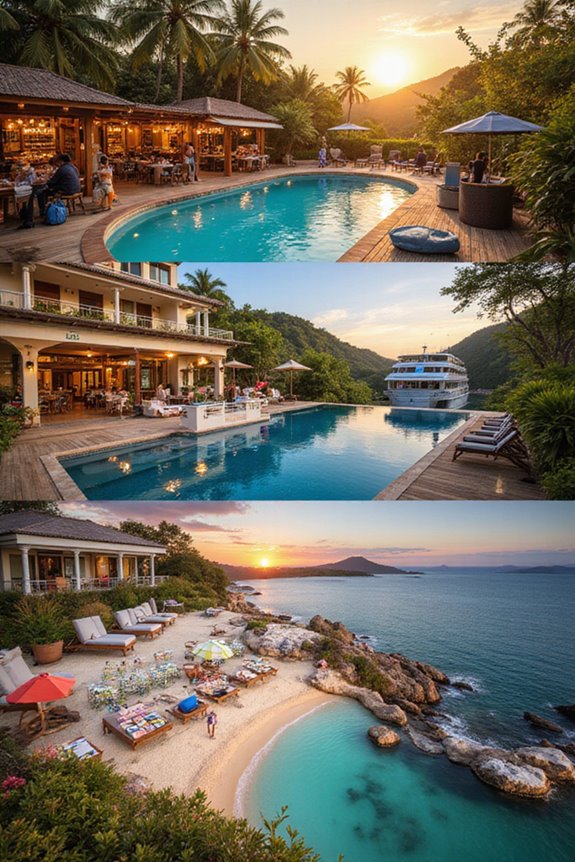

When I think about planning my next vacation, it’s hard not to get excited about the average vacation budgets for 2025. Did you know the average U.S. traveler is expected to spend around $5,051 per trip? That’s a significant jump from last year! With nearly 80% of Americans planning at least one getaway, it’s clear that travel trends are shifting. I love how budget variations allow for different experiences, like splurging on a beach resort or saving with off-peak travel. Summer travel spending alone is projected to grow by 21%, which makes me wonder how I can maximize my budget. I’m definitely considering using travel rewards to offset costs—who doesn’t love a good deal?

Demographic Influences on Travel Spending

As I plunge into the world of travel spending, it’s fascinating to see how different generations shape their budgets and experiences. Millennials, for instance, are all about blending work and play, often embracing “workcations” to maximize their travel days. Meanwhile, Gen Z prioritizes sustainable travel, opting for eco-friendly transport and accommodations. Baby Boomers, on the other hand, lean towards leisurely trips focused on relaxation and family time. Each group has unique spending habits that reflect their values—whether it’s indulging in local experiences or simply enjoying a quiet beach getaway. As I navigate these generational travel trends, I can’t help but appreciate how our backgrounds influence our choices, making every trip a personal reflection of who we are.

Key Factors Driving Increased Vacation Budgets

While I can’t deny that the thrill of planning a vacation is part of the fun, it’s also hard to ignore the rising costs that come with it. With Americans budgeting around $5,051 for vacations in 2025, it’s clear we’re all feeling that influencer impact. I mean, who hasn’t been tempted by a stunning Instagram post? It’s like social media is saying, “You need to visit this trendy spot!” Plus, with more folks planning to travel more often, it’s no wonder budgets are expanding. Loyalty programs sweeten the deal, nudging us to spend even more. Additionally, travel books can provide valuable insights on budget accommodations and local transportation options, helping to keep costs in check. So, as I dream of my next getaway, I realize my budget might just stretch a little further than I initially planned!

Types of Travel and Their Associated Costs

Traveling can be one of the most exhilarating experiences, but it’s essential to know that not all types of travel come with the same price tag. For instance, RV vacations are often budget-friendly, saving you on accommodation and letting you control food expenditures. In contrast, international travel can hit your wallet harder, especially with airfare and accommodation costs soaring. I always hunt for airfare deals to ease transportation expenses! Plus, remember those pesky miscellaneous expenses like visas or souvenirs. Seasonal pricing can also change your budget drastically. Safety features importance can also influence your overall travel expenses, especially when traveling with electronics needing voltage converters. Whether it’s the thrill of an RV road trip or the allure of exploring foreign lands, understanding these costs can help you plan a vacation that fits your budget and dreams.

Seasonal Budgeting Considerations

When planning a vacation, it’s essential to contemplate how the season can impact your wallet, especially if you want to keep your budget in check. I’ve learned the hard way that seasonal pricing can really throw a wrench in my plans. For instance, traveling during summer or holiday breaks can jack up flight and hotel prices by 20-50%. But, oh, the off-peak advantages! Late fall or early spring trips usually mean fewer crowds and way better deals. I’ve snagged some awesome hotel rates just by being flexible with my dates. Plus, if you plan your getaway during the shoulder season, you can enjoy nice weather without breaking the bank. Trust me, your wallet will thank you!

Effective Budgeting Practices for Travelers

Budgeting for a vacation can feel like trying to solve a puzzle, but it doesn’t have to be overwhelming. I’ve found that effective savings strategies start with clear expense tracking. First, I break down my budget into categories: transportation, accommodation, food, and activities. Then, I make sure to allocate funds for each, leaving some wiggle room for those spontaneous adventures. I also love utilizing travel rewards—those points can be a game-changer! I track them carefully to maximize my savings across multiple trips. Plus, I’ve learned to take advantage of off-peak travel to score better deals. By planning ahead and being mindful of my spending, I can enjoy my vacation without the financial stress.

Addressing Common Budgeting Challenges

Even if you’ve got a dream vacation in mind, tackling common budgeting challenges can feel like trying to navigate a maze without a map. I’ve been there—facing budgeting pitfalls like underestimating total costs or forgetting unexpected expenses. It’s crazy how quickly things add up, right? You think you’ve got it all figured out, and then boom—tips, resort fees, and transportation pop up like unwelcome guests. Plus, with inflation, those flights and meals are pricier than ever! I learned to keep an emergency fund handy and do my research early, avoiding last-minute splurges. Balancing travel fun with savings can be tricky, but a little planning goes a long way in keeping my budget intact and my vacation dreams alive!

The Role of Loyalty Programs in Travel Budgets

How can those travel loyalty programs really change the game for our vacation budgets? Well, I can tell you from experience that loyalty rewards can be a game-changer! When I started using these programs, I found myself saving a ton on flights and hotels. By strategically accumulating points, I could splurge a little more on experiences, like fancy dinners or unique tours. Plus, personalized offers often popped up just when I needed them, guiding my budgeting strategies. It felt like magic! With brands like Marriott and Delta leading the charge, the ease of redeeming points has never been better. So, if you’re not hopping on the loyalty train yet, you might be leaving money on the table for your next getaway!

Utilizing Travel Tools for Better Budget Management

When I finally embraced travel tools for better budget management, it felt like I’d discovered a secret weapon. I started using travel apps, and wow, they transformed the way I handle my vacation finances! I love how these apps automate budget tracking, so I never overspend without realizing it. They help me compare prices on flights and hotels, making it easy to snag those sweet deals on the go. Plus, I can categorize my expenses and keep all my receipts right on my phone—no more lost paper trails! With real-time updates and alerts, I can adjust my spending instantly. Trust me, integrating these digital tools into your travel planning not only saves money but also reduces stress.

Planning for Ancillary Costs in Your Vacation Budget

While planning my vacations, I’ve learned the hard way that it’s not just the flight and hotel rates that can drain your wallet. Those pesky ancillary fees can really sneak up on you! I remember one trip where my “affordable” flight turned into a budget buster with baggage fees and seat selection charges. Then there were those surprise resort fees at the hotel that I didn’t see coming. And let’s not forget about transportation costs—tolls, parking, and insurance can add up fast. When it comes to dining, those room service charges can put a dent in your budget too. So, I always make sure to account for these potential vacation surprises, ensuring my budget stays intact and stress-free!

Frequently Asked Questions

How Can I Save Money on Travel Without Compromising Experiences?

When I travel, I use travel hacks like booking off-peak flights and staying in budget accommodations. I also prioritize budget activities that offer local experiences, ensuring I save money while enjoying every moment of my trip.

What Are the Best Times to Book Flights for Cheaper Rates?

When I look for cheaper flight rates, I use flight comparison tools and set booking alerts. I’ve found booking 21 to 52 days ahead often yields the best deals, especially on Sundays.

How Can I Find Budget-Friendly Accommodations While Traveling?

Finding affordable places to stay is a delightful adventure! I often explore hostel options and vacation rentals online. They offer great value and unique experiences, helping me stretch my travel budget without sacrificing comfort.

Are There Apps That Help Track Travel Expenses Effectively?

When it comes to expense tracking and travel budgeting, I’ve found apps like Trabee Pocket and Wanderlog really helpful. They simplify keeping tabs on my spending while making trip planning a breeze.

How Do I Handle Unexpected Travel Expenses During My Trip?

When the unexpected storms in during my travels, I’ve learned to keep emergency funds ready and invest in travel insurance. It’s my safety net, allowing me to navigate those turbulent waters with ease and confidence.