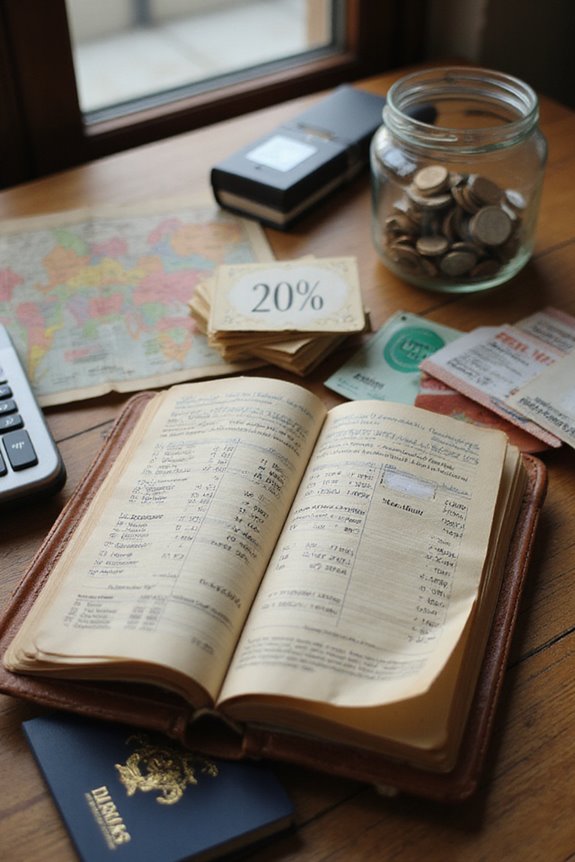

The 50/30/20 rule is a trusty guide I use for travel budgeting! I break my after-tax income into three easy categories: 50% for needs like rent and food, 30% for my travel wants like cool excursions or fancy meals, and 20% goes into savings and paying off debts. This balance keeps my wallet happy and guarantees I enjoy my adventures without the stress! Stick around, and I’ll share some tips for applying this rule to your travel plans!

Key Takeaways

- The 50/30/20 rule divides after-tax income into 50% needs, 30% wants, and 20% savings/debt repayment for effective budgeting.

- For travel budgeting, allocate 30% of your income to cover travel-related wants and experiences.

- Budgeting for travel prevents overspending, ensuring balanced spending on tickets, accommodations, and local activities.

- Within the needs category, ensure essential expenses like rent, food, and transportation remain under 50% for financial stability.

- Utilize the 20% savings allocation for building an emergency fund and preparing for future travel adventures.

Understanding the 50/30/20 Rule

Have you ever felt like your paycheck disappears before you can even catch a breath? I know I have! That’s where the 50/30/20 rule comes in. It’s a simple yet powerful budgeting method. Basically, it breaks your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings or debt repayment. I’ve found that following this rule really helps with travel budgeting. That 30% for wants? Yep, that’s my travel fund! It’s amazing how making sure essentials are covered lets me enjoy life without guilt. Plus, knowing I’m setting aside 20% for future plans—like that dream vacation—gives me peace. With this balance, I’m steadily working towards my financial goals without losing joy in the journey!

The Importance of Budgeting for Travel

Budgeting for travel isn’t just a smart move; it’s a game-changer. I’ve learned the hard way that financial awareness can make or break a trip. Imagine this: I once splurged on airline tickets and then panicked about my hotel costs. That’s not a fun way to kick off an adventure! When I embrace budgeting, my travel experiences become richer. I can confidently chase those local eats or spontaneous excursions without drowning in debt. Plus, I’ve found that planning helps prioritize what really matters. Thanks to tools like price comparison sites, I scope out the best deals. Ultimately, a budget means I savor each moment instead of stressing about money, turning every trip into a stress-free experience.

Break Down of the 50% Needs Category

When it comes to managing finances, the 50% needs category can feel like a lifebuoy tossed your way in stormy seas. This chunk of your budget covers essentials—things that keep you ticking, like rent, utilities, food, and transportation. Trust me, needs prioritization is key here! If you find yourself splurging on these essentials, it’s time for essential budgeting adjustments—maybe downsizing your apartment or cooking at home instead of dining out. I remember when I started meal planning; it was a game changer! Dealing with unexpected expenses? Always stressful. But keeping your needs within 50% helps you breathe easier, knowing your essentials are secure, and leaves room for fun stuff later, like travel adventures!

Allocating 30% for Wants: Travel Considerations

Allocating 30% of your income for travel wants isn’t just a number—it’s your ticket to adventure! This portion lets you indulge a bit, covering everything from fancy dinners to that breathtaking guided tour you can’t resist. It’s essential to define your travel priorities; are you all about local cuisine or stunning accommodations? With expense tracking, you’ll stay within that 30% limit and avoid overspending. I’ve learned the hard way; last-minute splurges can derail your plans! Maybe you want the luxury of a rental car or those lovely souvenirs. Adjust this budget based on destination costs and how often you travel. Balancing it all makes your trips not only enjoyable but also financially smart. Happy traveling!

Maximizing the 20% Savings and Debt Repayment Category

Maximizing your savings and debt repayment can feel like walking a tightrope, but trust me, it’s totally worth the effort. I’ve learned that solid savings strategies, like building an emergency fund, really help avoid those financial pitfalls that can pop up out of nowhere. And hey, automating transfers to my savings account has made things easier—no temptation to dip into that cash! On the debt repayment front, tackling high-interest debts first has saved me a ton in interest. I set up the debt snowball method, which turned paying down debt into an exciting challenge. Remember, striking a balance between saving for rainy days and tackling those pesky debts keeps me on track for future adventures!

Benefits of Using the 50/30/20 Rule for Travel

Traveling can often feel like a juggling act, especially when it comes to finances. I gotta say, using the 50/30/20 rule has been a game-changer for me. It offers travel flexibility and lets me enjoy the best of both worlds—essential needs and fun splurges. By allocating 50% to critical expenses, I guarantee my accommodation and transport are covered. Then, with 30% for wants, I can indulge a little—maybe that fancy dinner or tour I’ve been eyeing! I love how simple it is to tweak budget adjustments without stressing over every little purchase. Plus, saving 20% gives me peace of mind for unexpected trip hiccups. Ultimately, it leads to a fabulous travel experience!

Practical Tips for Applying the Rule to Travel Budgeting

When it comes to sticking to a travel budget, a little organization goes a long way, trust me. First, calculate your net income after taxes—it’s essential for your travel budgeting foundation. Next, diligently track all travel-related expenses, especially for your first few trips. I swear by simple spreadsheets; it’s a game-changer! Allocate 50% of your budget to needs—think accommodations and essentials. Reserve 30% for wants, like that rooftop dinner or souvenir hunting; it’s where you can savor the little joys. Always save the final 20% for future adventures and emergencies. And don’t forget to reassess your budget after each trip to fine-tune your expense tracking. Happy travels, and remember: planning paves the way for unforgettable experiences!

Customizing the Rule to Fit Your Travel Goals

Although sticking to a budget might sound boring, personalizing the 50/30/20 rule can transform your travel experiences from ordinary to extraordinary. I’ve found that travel flexibility is key—by tweaking my “needs” to focus on essentials like lodging and meals, I’m free to reallocate funds in the “wants” category for unforgettable adventures, like a local cooking class or a hot air balloon ride. I even temporarily boost my savings if I’m eyeing that dream trip! Using budgeting tools to automate savings for unexpected costs helps keep stress at bay, too. When I plan ahead, I avoid overspending early on, ensuring that I savor every moment, not just the destinations. Additionally, investing in collapsible water bottles can help you stay hydrated on the go without taking up too much space in your luggage. Happy travels!

Frequently Asked Questions

How Do I Calculate My After-Tax Income for Budgeting?

To calculate my after-tax income for budgeting, I consider all my income sources, then subtract after-tax deductions, including taxes and retirement contributions. This gives me a clear picture of what I have to spend.

Can the 50/30/20 Rule Be Applied to Irregular Income?

Steering through irregular income feels like sailing a ship in shifting winds. I’ve found that embracing budget flexibility helps me adapt the 50/30/20 rule, ensuring my essentials are met while still saving for brighter days ahead.

What if My Needs Exceed 50% of My Income?

If my needs exceed 50% of my income, I use budget adjustment strategies for essential expenses management, cutting discretionary spending and exploring ways to increase my income. It’s tough, but I find a balance.

How Can I Track My Wants Spending Effectively?

Picture a chaotic marketplace; that’s how my wants spending used to feel. Now, I use budget tracking apps to categorize spending and set limits. It’s transformed my experience, letting me enjoy without guilt or overspending.

Are There Tools or Apps to Help With This Budgeting?

I’ve found budgeting apps like Mint and PocketGuard really helpful. They track my expenses, making it easier to set aside funds for travel. For planning, tools like TripIt streamline my trips effortlessly.